Understanding Additional Buyer’s Stamp Duty (ABSD) for Residential Property in Singapore

January 21, 2022

If you are buying any property as an individual in Singapore, you will be subjected to Buyer’s Stamp Duty (BSD). This is the base tax that every property buyer must pay, no two ways about it.

In this article we touch on the Additional Buyer’s Stamp Duty (ABSD), which is a tax you may need to pay on top of BSD.

(See: Understanding Buyer’s Stamp Duty (BSD) for Residential Property in Singapore)

The Additional Buyer’s Stamp Duty (ABSD) is applicable to:

- Singaporeans buying their 2nd residential property,

- Permanent Residents (PRS) and foreigners intending to buy their first (and subsequent) residential property in Singapore unless you are a citizen or PRs of these Free Trade Agreement (FTA) countries:

- Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland and Nationals of the United States of America.

- Entities which will not be covered in this article.

ABSD was first introduced in December 2011 as a cooling measure to help manage the rising property prices. There have been several revisions to ABSD rates since then with the latest being 16th December 2021.

| Types of Buyers | Rates from 6 Jul 2018 to 15 Dec 2021 | Rates on or after 16 Dec 2021 | |

|---|---|---|---|

| Singapore Citizens | 1st Residential Property | 0% | 0% |

| 2nd Residential Property | 12% | 17% | |

| 3rd and subsequent Residential Property | 15% | 25% | |

| Permanent Residents | 1st Residential Property | 5% | 5% |

| 2nd Residential Property | 15% | 25% | |

| 3rd and subsequent Residential Property | 15% | 30% | |

| Foreigners | Any Residential Property | 20% | 30% |

| Entities | Any Residential Property | #25% | #35% |

| #Housing Developers are subject to an additional 5% (non-remittable) | |||

In this article, we simplify the complexity of ABSD so that you are aware of whether you are required to pay this tax.

How is Additional Buyer’s Stamp Duty Calculated?

First, ABSD is taxed based on the higher of:

- The purchase price of the property bought or

- The market price of similar properties

Then it considers the residency/profile of the buyer.

The residency status will be used to determine the ABSD payable to the Inland Revenue Authority of Singapore (IRAS). The date of issue reflected on the Identity Card (IC) collection slip or on the IC itself will be used to determine if you are a Singaporean citizen or PR to enjoy a lower ABSD. Also to note, if a couple is made up of a Singapore Citizen (SC) and a PR and they both jointly own the same number of property count, the higher ABSD rate will apply. Example if John (SC) and his wife Jane (PR) decide to purchase a second property jointly. In this case as Jane is a PR, a ABSD rate of 25% (instead of 17%) will apply.

Residential Property Count for Individuals

- Once the Option-To-Purchase (OTP) has been exercised or Sales & Purchase (S&P) Agreement has been signed (even if not legally transferred), the property will be counted towards the would-be owner(s). Likewise, your property count will be reduced once the S&P Agreement has been signed to sell and your buyer has exercised the OTP.

- Buyer owns, jointly, or partially owns any residential units in Singapore e.g., buyer partially owns (10%) of a residential unit with his / her parents, will increase the count.

- Properties that are under trusts, bequeathed by way of gift, inheritance, etc. will add to the count for the beneficiary

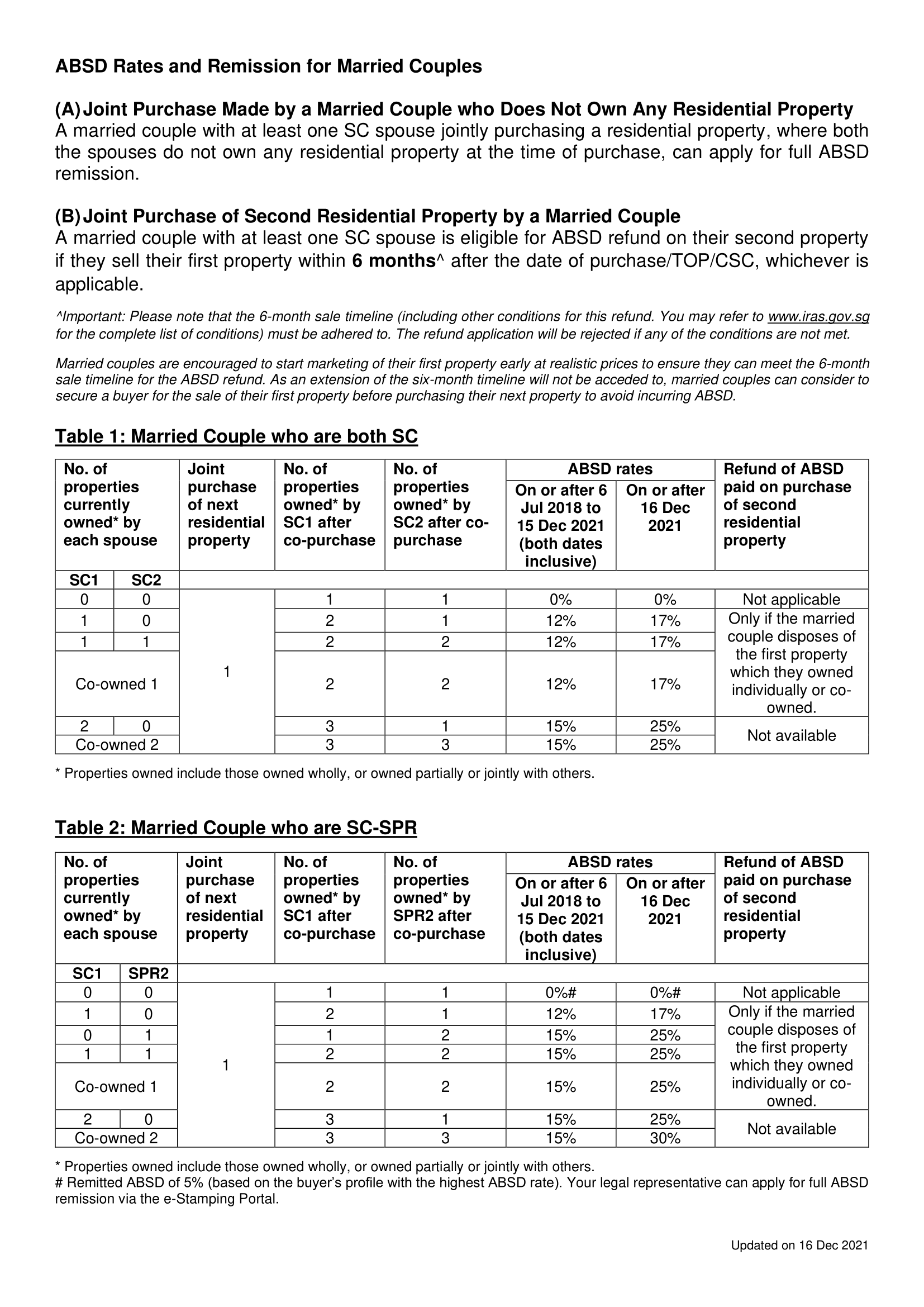

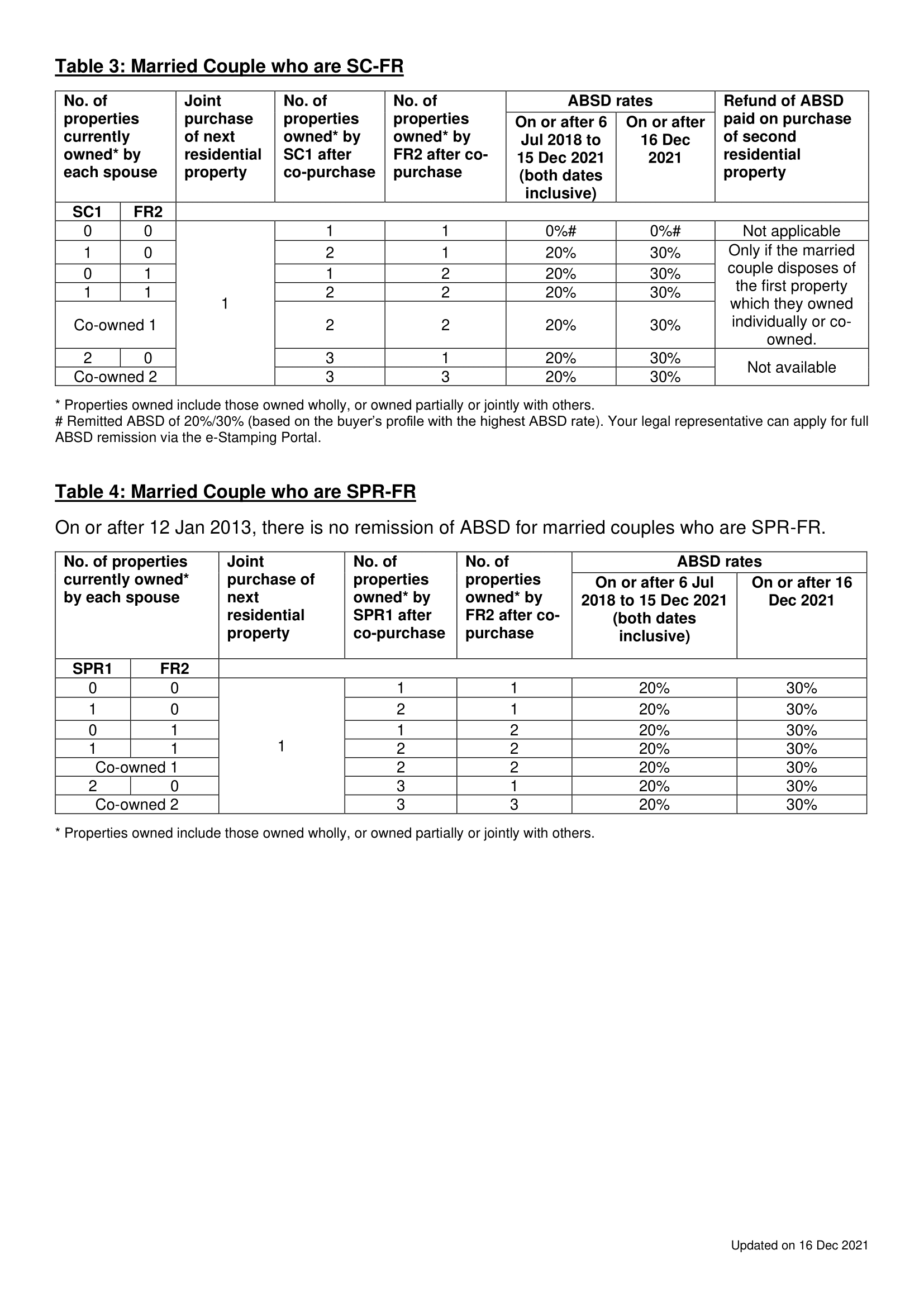

To make sure you get the count correct for your status, you can check these tables:

When and How To Pay ABSD?

ABSD must be paid within 14 days of signing the S&P Agreement. If the buyer is based overseas, he/she has 30 days to pay upon signing the S&P Agreement.

How to Pay Additional Buyer’s Stamp Duty

- e-stamp and pay the duties using the corresponding e-form from the IRAS’s e-Stamping website

- eNets, cheque, or a cashier’s order.

- e-Terminals at the IRAS Surf Centre, and SingPost Service Bureaus.

Additional Buyer’s Stamp Duty Declaration Form

Do note that all buyers/transferees have to complete this ABSD Declaration Form and notarize it in the presence of their lawyer. The copy need not be submitted to IRAS but be kept for at least 5 years from the date of acquisition for audit purposes.

ABSD Remission

(A) Joint Purchase Made by a Married Couple who Does Not Own Any Residential Property

A married couple with at least one SC spouse jointly purchasing a residential property, where both the spouses do not own any residential property at the time of purchase, can apply for full ABSD

remission.

ABSD Refund

(B) Joint Purchase of Second Residential Property by a Married Couple

A married couple with at least one SC spouse is eligible for ABSD refund on their second property if they sell their first property within 6 months^ after the date of purchase/TOP/CSC, whichever is

applicable.

For more information, please refer to the IRAS website at Remission of ABSD for a Married Couple

Exemption from Additional Buyer Stamp Duty

Can ABSD be exempted legally? This is the million-dollar question you may be asking. We will explore this question in detail in a separate article.